Market Commentary | September 18, 2025

Resuming the Path to Lower Interest Rates

After a seemingly interminable 9-month pause, on September 17th, Jerome Powell’s Central Bank cut the Fed Funds rate by 25 basis points. As real estate is considered one of the most interest rate-sensitive sectors, this is indeed good news. As suppliers of space, commercial landlords’ access to more affordable lines of credit or lower-cost capital to finance/refinance acquisitions enhances profitability. On the demand side, manufacturers, service providers, merchants, and business tenants of all types are strengthened by reduced financing costs—another first step in the right direction.

Progress will not likely be made in a straight line

We recently published a report detailing our rationale for buying the deeply discounted Gladstone Land preferreds (LANDO, LANDP). We view these issues as particularly opportunistic, as current market prices allow one to lock in a dividend yield of 7.5%+ and potentially benefit from capital appreciation due to management’s outsized share repurchase program.

In response, some members of the financial community noted that when the Fed first cut rates in 2024, yields on 10Y Treasuries actually rose. Their thinking is that investors might not chase higher yields through investment in riskier preferred shares if treasuries still offer high yields. That’s reasonable if we anticipate long bond investors will create demand for yield. Our anticipation stems from what is happening to the short end of the yield curve.

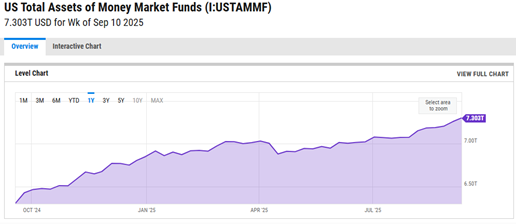

As the chart illustrates, more than $7.3 trillion now sits in US money market funds. The Federal Reserve’s cutting of short-term rates reduces the yield on money market accounts.

A large share of that $7T will stay in the riskless liquidity of money markets even as yields drop, but if, say, 10% ($700B) takes on risk in pursuit of yield, the limited supply of higher-yielding securities might face a large, new demand surge. Discounts on preferred share prices could shrink substantially.

Estimating an uncertain future

No one really knows the exact direction of macroeconomics or interest rates. Our efforts try to identify potential opportunities under different scenarios. The result could bring us profit. In the meantime, we are happy to receive 7%+ yields on the preferred shares as it unfolds.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.