Supply and Demand

The Law of Supply and Demand is a foundational principle of economics.

As an example, consider that the supply of steel would be determined by the availability of iron (Fe) and the perceived demand for steel. The steel demand would, in part at least, be determined by production plans for manufacturers of automobiles, airplanes, and appliances. If steel demand is anticipated to be strong, a savvy investor would selectively buy shares in steel suppliers.

When it comes to fixed income investing, however, defining supply and demand can become a little bit nebulous.

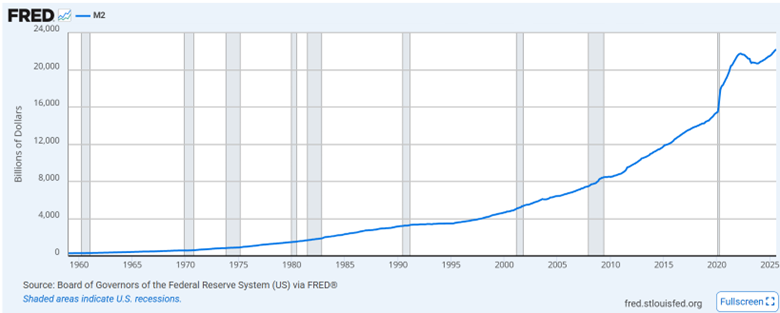

We are currently obsessed with the massive volume of cash that has accumulated in money market funds. According to a September 11th release from the Federal Reserve Bank of St. Louis (FRED), total money market fund assets had increased to a record $7.31 trillion (that’s trillion, with a T). Historically, this sum represents an above-average share of total money supply (M2), currently estimated at $22 trillion.

From pre-pandemic levels of $15T, M2 has expanded approximately 47% to today’s totals. At the same time, Money Market funds have grown from $3T to today’s $7.3T or about 143%.

Getting back to defining supply and demand, money markets have achieved a heretofore unprecedented stasis. It seems the $7T that capitalizes money funds has become both the supply and demand. The mountain of cash has been satisfied by ambient, high, riskless, liquid, short-term yields available in the Fed’s current higher rate environment.

A Change is in the Air

We acknowledged some time ago that predicting the direction of interest rates presents a high probability of being wrong. That educational process has encouraged us to investigate strategies and markets that function better in whatever environment evolves. We see the current markets for discounted preferred equities as particularly opportunistic.

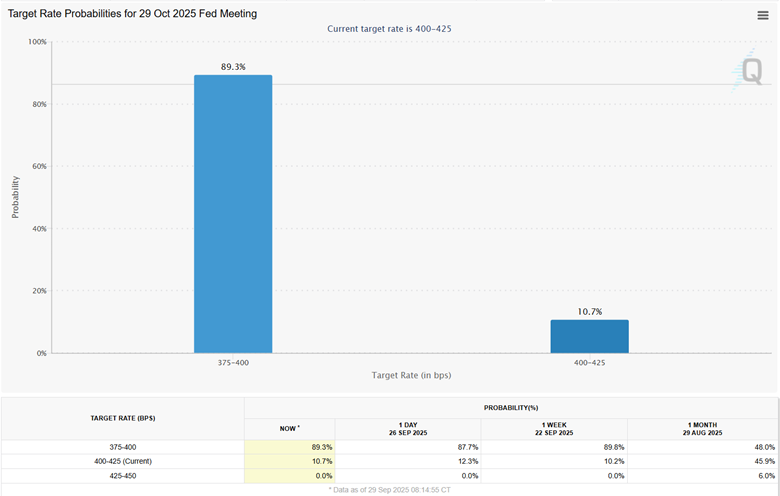

Despite cautionary, even hawkish, commentary from various Fed Governors, the market largely anticipates we will see another 25-basis point cut in the Fed Funds rate at the October meeting.

Would such a cut upset the equilibrium in money market funds? The $7T currently parked in money markets will continue to demand a return on assets. As the Fed Funds rate declines, so does the money funds’ ability to supply yield sufficient to meet demand. When rates fall, will funds migrate in search of higher yields?

In uncertain environments, we want to mimic the savvy steel investors. We want to own the yield suppliers. The $ trillion+ preferreds market is a known supplier of higher yields. Discounted preferred equities supply higher yields and potentially much more.

Sifting through a thoroughly analyzed universe of more than $100B REIT preferred shares, 2nd Market Capital has identified more than 5 dozen issues that supply yields 300 basis points above 10Y Treasuries at prices that present capital appreciation potential of 10% to 30% to par valuation. This yield plus appreciation forms the modus operandi of Baseline +.

Our Baseline + Asset Management Accounts are actively managed, focused on a dividend yield spread over Treasuries and Corporate bonds (the Baseline), investing primarily in discounted preferred REIT shares and discounted common shares with a goal of capturing capital appreciation (the +). Baseline + buys and sells yield supply.

Opportunistic Market Pricing

Beginning October 1st and running through March 31, 2026, you can join Baseline + in its pursuit to buy the yield suppliers by opening a Baseline + asset management account with an initial investment of as little as $10,000 ($7,000 for IRA accounts!). Additionally, our custodian, TradePMR, will credit your account with a 0.5% cash match of your cash deposit or transfer of eligible securities from another financial institution made during this time period!

To become a Buyer of Supply, contact Simon Bowler or Dane Bowler at 2MCAC today

Dane Bowler is 2nd Market Capital Advisory’s Chief Investment Officer. He has over a decade of experience running a proprietary portfolio with a specialization in REITs. On-site property tours and critical analysis of REIT management help inform his selection process. To learn more about our advisory services, contact Dane at 608-800-7267 or dbowler@2ndmarketcapital.com, You can also schedule a 15-minute intro meeting with Dane here.

Simon Bowler is the Chief Communications Officer of 2nd Market Capital Advisory. He continuously conducts thorough data analysis on the REIT sector in order to identify potential investment opportunities and has published the monthly State of REITs article series on Seeking Alpha since 2018. To learn more about our advisory services, you can reach Simon at 608-800-7628, sbowler@2ndmarketcapital.com or schedule a 15-minute intro meeting with Simon here.

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin-registered investment advisor specializing in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation. Dane Bowler and Simon Bowler are investment advisor representatives of 2MCAC.

TradePMR Asset Match Program Terms and Conditions

Important Notes and Disclosure

Material Market and Economic Conditions. Early 2025: REITs stayed relatively stable in the presence of tariff discussions that spooked the broader market. REITs were viewed as relatively isolated from world trade.

Material Conditions, Objectives, and Investment Strategies. Baseline + is an actively managed investment strategy focused on a dividend yield spread over Treasuries and Corporate bonds, investing primarily in discounted preferred and common REIT shares with a goal of capturing capital appreciation.

Unless identified as Hypothetical, all Performance information on this page is based on the Baseline + composite account; the average of all fee and non-fee paying discretionary accounts that are similarly managed, including closed accounts that are part of the period covered. Performance of the discretionary accounts included in the composite is calculated by Interactive Brokers on a daily time-weighted basis, including cash, dividends, and earnings distributions, and reflects the deduction of 2nd Market Capital’s advisory fee to reflect performance net of fees. Actual client returns may differ.

Yield on Invested Capital Chart. Yield on Invested Capital represents the total annual indicated dividend income (or interest) divided by the contributed capital. 2MC Baseline + is a representative account; a portfolio with substantially similar investment policies, objectives, and strategies as those of our Baseline + asset management accounts. The representative account’s capital contribution was $100,000 on 7/02/2024; dividends are reinvested. The 10-year Treasury Note is a benchmark for long-term interest rates and pays interest (not dividends) semi-annually at the rate fixed at purchase. Yield on Invested Capital for the 10-year Treasury represents annual interest income divided by the initial capital contributed invested on 7/2/2024 with assumed pay periods of 9/30/2024, 3/31/2025, 9/30/2025 and every six months, with reinvestment of interest payments. Actual advisory client total return will be impacted by capital gains/losses and reduced by the 1% annual advisory fee. Future dividend yield is subject to change.

The performance in a 2MCAC client account investing in Baseline + may differ (i.e., be lower or higher) from the performance of the representative account portrayed on this page based on a variety of factors, such as trading restrictions imposed by the client (resulting in different account holdings), time of initial investment, amount of investment, frequency and size of cash flows in and out of the client account, and different corporate actions. Clients investing in this portfolio may view the actual performance of their investment in this portfolio by logging into their Interactive Brokers account and reviewing their customized dashboard.

Clients may restrict any of the securities traded in their account, but should note that any restrictions they place on their investments could affect the performance of their account leading it to perform differently, worse or better, than (a) the above-portrayed account or (b) other client accounts invested in the same strategy.

Forward-looking statements. Commentary may contain forward-looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in these documents.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this commentary have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

Use of Leverage or Margin. Baseline + Portfolio will utilize margin only for trading purposes (the ability to use the proceeds from stock sales immediately for new purchases instead of waiting for the usual 1-day settlement period), but not for borrowing purposes.

Expenses. Returns reflect the deduction of advisory fees and any transaction expenses .

Calculation Methodology. Returns are calculated by Interactive Brokers LLC using the Modified Dietz method, a time-weighted measure of performance in which cash flows are weighted based on their timing. Dividends in Baseline + accounts are reinvested.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P