Recent Reads | Frostbite

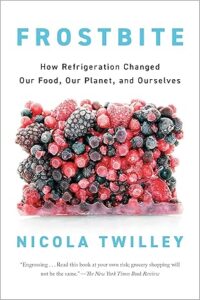

Like most good cities, Madison sponsors an annual book festival. Last year’s program included fiction and non-fiction from local, national, and international authors, and my favorite event was the presentation by Nicola Twilley, author of Frostbite.

Frostbite details the history and evolution of the food supply chain through the development of cold storage technologies. As eaters, we can all relate to how this history has transformed our lives and health. As an investor, I was intrigued to learn more about a growing industry that I had previously not been informed about or brave enough to put capital at risk.

Ms. Twilley’s book provides a detailed history of food storage methods that predate electricity, to ice houses, to refrigeration, to today’s industrialized cold-chain warehouses. Reading the book is thought-provoking and time well spent. You can get a topic sample by viewing the author’s Book Festival presentation here.

Though I read the book almost a year ago, reviewing it now is timely because of stock market dynamics. Americold Realty Trust (COLD) and Lineage, Inc. (LINE) are publicly traded cold-storage industry leaders. Prior to 2025, COLD and LINE each traded at nosebleed, premium multiples to their industrial real estate sector peers and share prices too rich to appeal to our value-driven investment perspectives. In the last year, however, Americold and Lineage shares have fallen 50% and now trade at discounts on earnings multiple versus their sector, and below Net Asset Value.

We’re not making stock recommendations here, just conveying that reading Frostbite was time well spent in the gathering of knowledge. The book provided a historical foundation of the food industry that supplements our investment process. If you are curious about our current perspectives on Americold shares, check out Dane Bowler’s commentary on our website.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.