REIT Lost Decade: The Long-tail Effect of Market Manipulation

The S&P 500 had what is referred to as “the lost decade” at the turn of the century. S&P returns were close to zero from 2000 to 2010. The REIT lost decade was 2015 to 2025.

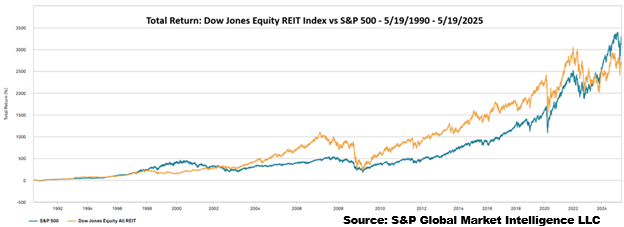

At the end of such a bad period, it is understandable that sentiment on REITs is extremely low. It has led many to believe REITs are just not a good asset class. However, a longer-term look at history will show that the weakness is isolated to specifically this period and that REITs have overall performed largely in line with the S&P.

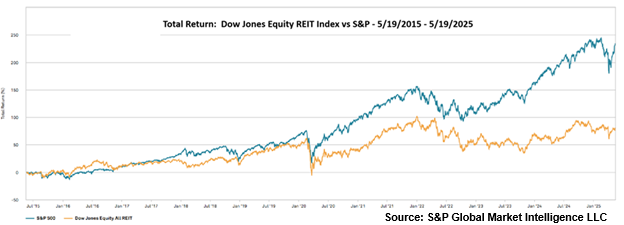

Lost REIT Decade 2015-2025

REIT total return in the last decade has been dismal at about 70% while the S&P returned about 230%.

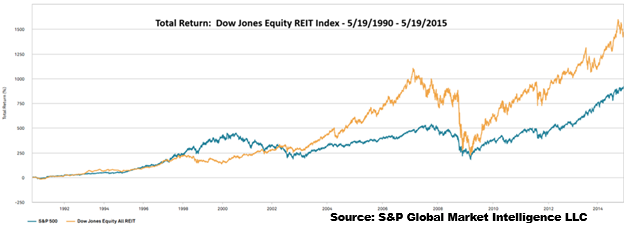

In the 25 years before this decade, roles were reversed, and REITs trounced the S&P.

If we look at the full 35-year period, returns between REITs and the S&P are quite similar. Notably, the returns of both indexes are very strong.

Given the long term history, I don’t think it is correct to look at the past 10 years and conclude that REITs are a bad asset class. Every asset class has gone through bad cycles, and the end of a “lost decade” is often a great time to get in.

If one had invested in the S&P in 2010 after its lost decade, their returns would have been excellent. It could potentially be a similar opportunity for REITs today, but first, it behooves us to understand what caused such a challenging period. If we understand the etiology, we may have a better shot of estimating the start of the rebound.

The economy is enormous and complex, so there are likely a confluence of causes rather than a single cause. As such, please take the reasoning below as a working hypothesis as to the primary cause. It is far from definitive proof, but I do think there is substantial evidence to back it up.

Hypothesis: REIT Lost Decade was caused by ZIRP (Zero Interest Rate Policy)

REITs, perhaps even more than the broader market, have a natural equilibrium in which returns are guided toward a certain level. Since real estate is such a large financial investment, any entity that commits to building a property goes through rigorous underwriting to anticipate return on invested capital.

Developing involves risk as well as a time delay before returns are realized, so the threshold of returns to make a project viable is fairly high. If a property type is oversupplied, new projects will not meet this return threshold. This keeps supply in check so that the right number of buildings are developed and occupancies tend to stay in a healthy range.

Or at least that is how it SHOULD work when free market forces are allowed to do their thing. Sometimes free market forces are tinkered with, and this can drastically throw off the equilibrium. I believe such tinkering is the source of the abysmal returns of REITs in the past 10 years.

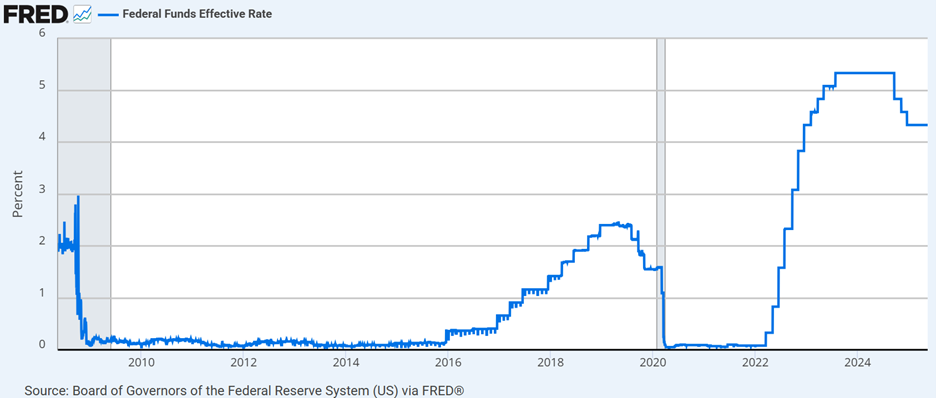

Interest rates are ordinarily controlled by the free market, but at certain times in history, the Federal Reserve has stepped in and overridden free market forces. The largest external manipulation began in the Financial Crisis of 2008-2009. To help stimulate the economy in what was the most severe recession of modern history, the Federal Reserve cut the Fed Funds rate to effectively 0%.

This move largely achieved its desired effect. It did stimulate the economy and helped the U.S. to recover from the recession. Such emergency measures are often referred to as the “Fed Put,” and similar tactics were used again during the COVID-related recession.

When used in this emergency capacity, the side effects are somewhat limited. While the economy was still in recession, developers remained hesitant to build. The problem, in my opinion, is that the emergency 0% interest rate was left in place well beyond the economic recovery.

In 2011 there was no recession, yet the Fed Funds rate stayed at 0. In fact, it stayed at basically 0% until December of 2015 when the Fed hiked to a range of 0.25%-0.50%.

Coincidentally, this first Fed hike corresponds to the start of the lost decade for REITs. I suspect it was the temporal correlation that led the market to believe that Fed hikes were the bane of REITs. Ever since that time, the REIT market has been jittery around the subject of interest rate hikes, and the daily trading correlation between REIT prices and market anticipation of Fed hikes has been strongly negative.

While that is undoubtedly the trading pattern, REITs are operating businesses with fundamentals that go well beyond stock price. I posit that REITs were sick well before the start of the lost decade. Fed rate hikes were merely the yucky tasting medicine to cure the ailments induced by the interest rate manipulation of 2011-2016.

Interest rate manipulation caused a drastic oversupply of real estate

Quite simply, 0% interest rates broke the equilibrium mechanisms inherent in real estate.

Consider a normal environment with 5% interest rates. To make a development worth the risk and time delay, a project would have to have a stabilized NOI yield of at least 8%, but probably closer to 9%. As such, only the best developments would get the green light, and the overall volume of new supply would remain in check.

Well, in the manipulated interest rate environment, developers had access to absurdly cheap debt:

- Long-term senior notes with rates occasionally below 3%

- Secured mortgage financing in the 3%-4% range

- Cross-collateralized mortgages in the low 3s.

When rates are that low during a recession, it doesn’t cause problems because access to financing is still tight. However, when rates are that low during a strong economy, the capital just flows. The spigot is wide open, and suddenly developments with 5% NOI yields and sometimes even 4% NOI yields start to work.

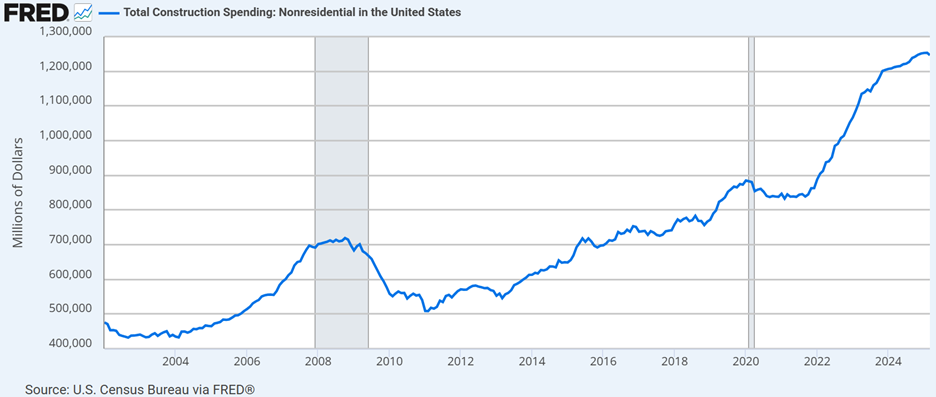

So developers went from just green-lighting the best projects to basically green-lighting everything. It shows up in construction spending.

Note that there is a substantial delay between project underwriting and the bulk of the construction spending. As you can see, construction spending was actually high during the Financial Crisis of 2008-2009. That was not projects underwritten at that time, but rather those already committed before the recession. Similarly, the zero interest rates of 2011 and 2012 show up in the sharp increase starting in 2014.

Interest rates didn’t get materially above 1% until 2018, which results in construction spending continuing to rise through 2020.

The higher interest rates of 2019 were starting to reduce construction starts, but then the COVID recession took rates back down to 0. In 2021, the pandemic faded, yet rates remained at 0, so construction starts resumed their breakneck pack. The delayed effect has taken construction spending to all time highs in 2024. Starts began to moderate in 2023 and have slowed to a crawl in 2025.

Overbuilding created an oversupply which had 2 key impacts on REIT operations:

- Occupancy declines in oversupplied property types

- Tenants gained power in negotiations, which led to onerous terms

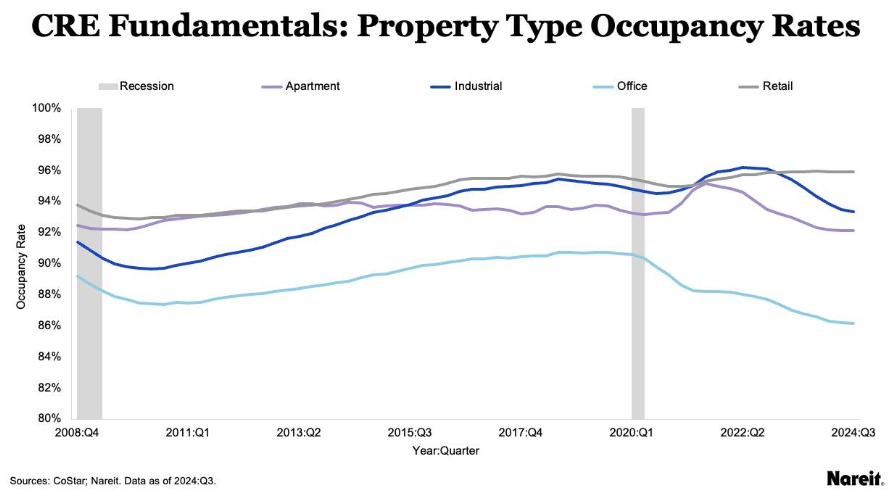

Below, NAREIT has charted occupancy over time in the largest property types.

At first glance, the impacts of supply may not be evident, but keeping in mind the time delay on completions and the dynamics of individual property types, I think it does demonstrate the pattern.

As a control group, we can look at retail because it has had virtually no new supply since the Financial Crisis. Note how retail occupancy (the grey line) consistently grew all the way up to the pandemic.

In contrast, apartments were subject to the zero-interest-rate-inspired overbuilding. Apartment occupancy increased through 2014, and then the new supply started to tick occupancy down despite what was a fairly strong demand environment.

Industrial occupancy grew through about 2017, at which point the supply wave started to take it back down. The downward occupancy in 2018 and 2019 is particularly notable in industrial because it was amidst a seismic boom in demand as e-commerce continued to gain market share.

Prologis (PLD) wrote a white paper on how e-commerce would multiply demand for logistics real estate. That has since largely been proven true. Even still, occupancy remained muted because the supply wave was just so intense.

While the impacts of oversupply brought on by the zero-interest rate environment do somewhat show up in occupancy as highlighted above, the impact to NOI was significantly more profound because of what it did to leasing negotiations.

As new properties lease up, they often offer incentives to reach critical occupancy faster. These incentives include:

- Free rent periods

- Renewal options (at tenant’s option)

- Large tenant improvement allowances (for signage and customization)

For much of that high supply period, these sorts of leasing dynamics unfortunately became the norm. Even existing buildings would have to offer similar incentives.

This took net effective rent far below stated rent per square foot and, in my opinion, is what led to the somewhat anemic AFFO/share growth of REITs. Current fundamentals are still dealing with the glut of supply created by ZIRP, but we are well beyond the worst of it.

The end is in sight

Across just about every real estate asset type (data centers excluded), new construction has come way down.

Don’t take my word for it. There is phenomenal third-party research out there (available for free) from the likes of Yardi Matrix, Marcus and Millichap, Co-Star, Real-Page Analytics, and various other industry publications. They cite real data showing a dramatic decline in permits, construction starts, and other leading indicators of future supply or real estate.

Equilibrium is well on its way to being restored.

Investment implications

The stock market has been far too concerned with rising rates and continues to sell off REITs when the Fed makes announcements like Atlanta Fed President Raphael Bostic’s recent comments about only 1 cut this year.

I see it completely differently. 4%-5% interest rates are healthy for real estate. They keep new construction low, which allows existing properties to have better leasing outcomes. Higher-for-longer interest rates will allow the next decade to look much more like the excellent REIT returns of 1990-2015 and avoid the ZIRP-induced struggles of the lost decade.

Sentiment as an opportunity

I would strongly encourage looking at the earnings reports of REITs as a barometer of fundamental health rather than looking in the rear-view mirror at stock price performance. Due largely to the weak returns of REITs over the past decade, sentiment in the sector is extremely low. Many view it as a broken asset class, and the lack of investor interest shows up in valuation.

The median REIT trades at:

- 5X 2025 estimated AFFO

- 7X estimated FFO

- 81% of NAV

I think this deep value, in combination with a clear rebound in underlying property fundamentals and growth rates, is a great setup. It is not an all-clear yet, but certain REITs and certain property types are well positioned.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.