RTR: Full Portfolio Review heading into 4Q25

This month’s update will focus on portfolio-level analysis and the process of the REIT total Return (RTR) portfolio. We also review performance at the end of each calendar quarter on a relative and absolute basis.

The main concepts we would like to discuss today with respect to how RTR is managed are:

- Compounding of income stream

- Fungibility of capital appreciation and dividends

- Differentiation from index

- Diversification by economic fundamentals rather than by correlation

- Current market opportunities

Let’s dig in.

Compounding of income stream

RTR has a high yield, but I think many high-yield portfolios err in following 2 specific rules:

- They exclusively buy high-yield securities

- They often have very high payout ratios

We do high yield differently at RTR, and to illustrate this, I refer to 2 data points:

- RTR’s aggregate dividend income is 10.4% of initially invested capital

- The dividend payout ratio is 64.85%

While the current yield of the portfolio is high at 5.58%, we don’t emphasize current yield; instead, we focus on the process of building yield over time.

There is a fungibility of capital gains and dividend income that I think gets overlooked by wealth managers who overly focus on the present-day dividend yield.

- When a stock pays us dividends, we can reinvest those into new stocks that pay dividends.

- When a stock appreciates, we can harvest the gains and reinvest the proceeds into new stocks that pay dividends

In that sense, capital gains and dividend receipts are effectively the same thing.

What matters is overall returns. Any returns, regardless of the source, can be used to increase future dividend income such that the income stream compounds over time.

We don’t chase yield or even require a stock to have a high yield. The portfolio currently holds Equinix (EQIX) and Farmland Partners (FPI), both of which have quite small current yields, at least by REIT standards.

Yet each of these stocks, and stocks like them which we have held in the past, contributes to the compounding of dividend income over time.

Eventually, we will sell EQIX and FPI, hopefully for substantial capital gains, which can then be redeployed into more stocks earning more dividends.

At the same time, we also hold stocks like Easterly Government Properties (DEA), which has a large dividend well covered by FFO. As dividends come in, they can be invested in more stocks with more dividends.

The point I am trying to make is that while RTR is a high-yield portfolio, stocks are not selected for the yield but rather for having strong fundamentals and favorable valuation. Specifically, we look for growing companies trading at substantial discounts to fair value.

A higher total return will eventually translate into a greater dividend income stream through the process of recycling gains

Performance

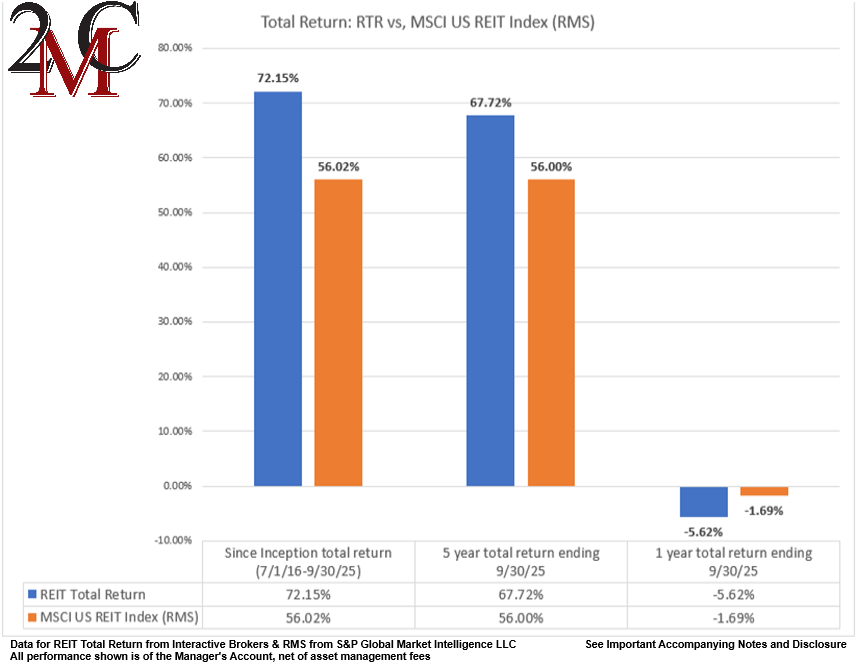

REITs as a sector have had a rough go in the last 6 or so years as the sector slid out of market favor and multiples declined. We try to make the best of a challenging situation and have substantially outperformed the index. RTR’s return since inception (7/1/16 through 9/30/25) is 72.15% compared to the MSCI US REIT index (RMS), which returned 56.02%.

2025 has been a fine year, but the 1-year performance of RTR is still suffering from a rough 4Q24 during which rate cut expectations got pared back materially, causing yield-sensitive sectors to drop.

While RTR consists entirely of REITs, our performance differs materially from that of the REIT index because our exposures are significantly different.

Index weight agnosticism

Portfolio managers are graded against an index. We are too, with our benchmark being the REIT index discussed above. However, the majority of money managers take this comparison so seriously that they begin to resemble the index.

There is even a term called “active weight,” which refers not to the weight one holds in a stock, but rather how their weight differs from that of the index. At times like today, when the stock market is extraordinarily top-heavy in market caps, portfolio managers would actually be considered to be negative active weight in stocks like NVIDIA (NVDA) if they had a 4% position size. The 4% holding is far less than the market cap weight of NVIDIA in the index, so the portfolio manager is underweight or functionally short the company.

In my opinion, the emphasis on active weight by most of this industry leads to closet indexing. Money managers have the best chance to outperform an index in the short term by having their portfolios look very similar to the index in general, with just a few high conviction deviations. That way, if they are right on the few areas where they differ from the index, they get to record a quarter of alpha and get to keep their jobs.

I am far more agnostic about the index. While outperforming the index, as we have, is pleasant, it is not really the outcome investors are seeking. Investors want maximal total returns.

Thus, we select stocks exclusively for our perception of their forward total return with a tweaking of weights to maintain proper economic diversification.

- When we bought Equinix (EQIX), we did not care that it made our portfolio slightly closer to the index. We simply liked the fundamentals and valuation of EQIX.

- When we increased our weight in UMH Properties (UMH), we did not care that it made our portfolio more different than the index. We simply liked the fundamentals and valuation of UMH.

Diversification is another concept that I believe is approached strangely by the wealth management business.

Diversification by economic exposure rather than correlation/covariance

Much of the institutional and academic approach to risk management is based on correlation and covariance. Indeed, if 2 stocks move similarly to one another, they are not really providing diversification, so I understand where the concept is coming from.

However, the problem I have with this style of risk management is that it is backward looking.

Beta, variance, and covariance are all calculated based on historical stock price movement. Thus, it is only telling you what stocks have moved together in the past rather than what stocks will move together in the future.

During my MBA program, I had a moment that really stuck with me: The students had to collectively manage a portfolio to certain risk parameters. Stocks that were too similar could not be purchased together for diversification purposes. Some of the students were researching Goodyear Tire (GT) while others were researching regional banks. When they attempted to put both GT and the bank in the portfolio, it was disallowed because of the historical covariance of GT with the bank.

It so happened that in the previous 5 or 10-year period (whatever the lookback window was), GT traded very similarly to the bank.

At the same time, it was allowed to purchase a 2nd bank stock because it so happened to have traded wonkily in the lookback window.

Any common-sense person would be able to tell you that 2 banks are more similar in economic exposure and provide less diversification than 1 bank and Goodyear. But that is not how covariance and correlation-based measures work.

I was baffled that the industry could possibly work in such a nonsensical way, so as I was touring the major institutional investment firms (Fidelity, Wellington, et cetera) as part of the MBA trip, I asked many of them how they handled risk management. Indeed, it is common practice to use variance, covariance, and VAR (value at risk).

It is likely a result of the short-term focused nature of the wealth management industry. 2 stocks that have traded together for the last few years are likely to trade similarly in the next 3 months.

If we take a longer run view, however, surely the long-term trading is going to be based on individual company fundamentals and economic sector fundamentals. At 2nd Market Capital, we are long-term focused, so that is how we handle diversification. We try to maintain exposure to a variety of underlying economic drivers, and specifically, economic drivers that have favorable long-term outlooks.

Diversification

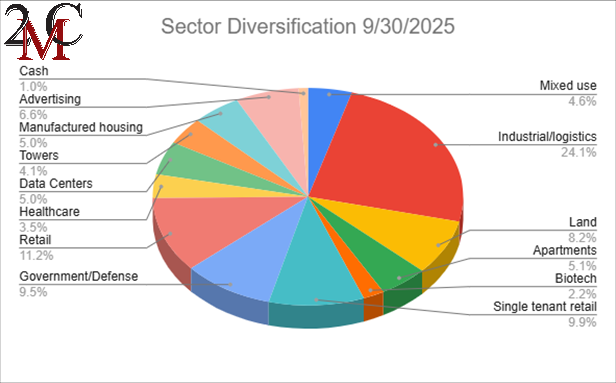

REITs contain a large number of different property types with distinctly different fundamentals. We intentionally avoid certain property types and overweight others

Industrial has become our largest exposure because I think the market has oversold the sector on temporary headwinds.

Recall that in 2020-2022, logistics demand was off the charts. Developers ramped up building in response, and as demand growth slowed back down to more normal levels in 2023 and 2024, the developers overshot a bit.

Due to time lag of development starts to completions certain markets and warehouse types (large footprint) became oversupplied and vacancy started to creep up to just over 8% nationally.

This is certainly a headwind, but a manageable and temporary one. Many industrial REITs have sold off to multiples that indicate low future growth, but fundamentals suggest significantly stronger growth. Demand growth has remained positive, and NOI, even in this challenging period, is strongly growing since the mark-to-market on rental rates was sufficiently large that rental rates continue to roll at +20% to +40%.

Importantly, development starts have trailed off considerably, so demand will once again overtake supply growth. In the near to medium term.

Current market opportunities

Our portfolio has a weighted average P/FFO of 11.6X compared to 20.15X for the REIT index.

The reason we are tilting more toward value presently is that there is a new group of stocks that has joined the ranks of value.

There is supposed to be a trade-off between value and growth. There is also supposed to be a trade-off between value and quality.

However, the current stock market seems to be very momentum heavy which has exacerbated mispricing and caused many high-quality and high-growth companies to sell off into value and deep value ranges. Certain stocks, despite having rock solid fundamentals, simply are not exciting enough to capture the attention of the market.

We like this sort of opportunity and have traded into these high-quality or high-growth names as they entered value territory. It is a cycle we have played many times before.

The idea is that as multiples get too cheap, we buy in, and then as pricing normalizes back to what we consider proper valuation, we sell. Many of the stocks in RTR we have owned multiple times in the past over previous valuation cycles. It is a combination of analysis and patience.

- We estimate fair value

- We buy when the stock price is well below fair value

- We wait for the stock price to return to fair value

It is not flawless. Fair value estimate can be mistaken. It is about batting average. We believe the trading pattern generally proves favorable.

Evolving economies create opportunity

Our REIT Total Return Portfolio is actively managed to pivot into wherever the opportunity is greatest. We are now offering portfolio mirroring in which the trades in our REIT Total Return Portfolio are automatically executed in client portfolios simultaneously and at the same price.

Important Notes and Disclosure

Material Market and Economic Conditions. March 2022-2023: Significant increases in the Federal Funds Rate by the Federal Reserve have caused REIT market prices to decline more than the broader markets. REITs rely on debt financing to acquire properties and fund their operations; expiring lower-cost debt is being refinanced at higher interest rates due to prevailing market conditions. March 2020: REIT Total Return’s value declined substantially as COVID shut down the economy. It recovered in 2021 as the economy reopened. January 2019: Tax-loss selling’s calendar expired and the government reopened on January 25, 2019. The combined effect caused our shares to rise more than the broader markets. December 2018: Another Fed-Funds rate hike, unresolved US-Chinese trade, a partial government shutdown, and an exaggerated tax-loss selling season put extreme downward pressure on equity prices. All of these factors contributed to diminished liquidity and more significant share price declines in small-cap/value issues; REIT Total Return is focused on small-cap/value issues, so our decline was significantly more precipitous.

Material Conditions, Objectives, and Investment Strategies. REIT Total Return is an actively managed investment portfolio of real estate equities, primarily common and preferred shares of REITs, with an aim to generate high total returns from a mix of dividends and capital appreciation.

All REIT Total Return Portfolio performance information on this page is based on the performance of the Portfolio Manager’s account, using the manager’s own funds. Performance of the Portfolio Manager's account is calculated by Interactive Broker on a daily time-weighted basis, including cash, dividends and earnings distributions, and reflects the deduction of broker commissions (when commissions were charged). Actual client returns will differ. **2nd Market Capital’s advisory fees are simulated and applied retroactively to present the portfolio return “net-of-fees”.

None of the performance information displayed on this page is based on the actual performance of any 2MCAC client account investing in this portfolio. The performance in a 2MCAC client account investing in this portfolio may differ (i.e., be lower or higher) from the performance of the account managing this portfolio and portrayed on this page based on a variety of factors, such as trading restrictions imposed by the client (resulting in different account holdings), time of initial investment, amount of investment, frequency and size of cash flows in and out of the client account, applicable brokerage commissions (when commissions were charged), and different corporate actions. Clients investing in this portfolio may view the actual performance of their investment in this portfolio by logging into their Interactive Brokers account and reviewing their customized dashboard.

Clients may restrict any of the securities traded in their account but should note that any restrictions they place on their investments could affect the performance of their account leading it to perform differently, worse or better, than (a) the above-portrayed account or (b) other client accounts invested in the same portfolio.

Forward-looking statements. Commentary may contain forward-looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in these documents.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this commentary have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

Use of Leverage or Margin. REIT Total Return Portfolio will utilize margin only for trading purposes (the ability to use the proceeds from stock sales immediately for new purchases instead of waiting for settlement), but not for borrowing purposes.

Benchmark Comparison. Our REIT Total Return Portfolio is compared to the Dow Jones Equity REIT Index and the MSCI U.S. REIT index because they are common REIT Indices. The Dow Jones Equity All REIT Index is designed to measure all publicly traded equity real estate investment trusts (REITs) in the Dow Jones U.S. stock universe. The MSCI US REIT Index is comprised of equity real estate investment trusts (REITs) eligible included within the eight Equity REIT Sub-Industries of the Equity Real Estate Investment Trust (REITs) Industry. It is not possible to invest directly in the Dow Jones Equity All REIT Index or MSCI US REIT index. Index returns do not represent the results of actual trading of investible assets/securities. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the index. The imposition of these fees and charges would cause the actual performance of the securities to be lower than the Index performance shown. The results portrayed include dividend income. Our REIT Total Return Portfolio may include REITs that are not eligible for inclusion in the Dow Jones Equity All REIT Index or MSCI US REIT Index.

There can be no assurance that a benchmark will remain appropriate over time and 2MCAC will periodically review the benchmark’s appropriateness and decide to use other benchmarks if appropriate.

Expenses. Returns reflect the deduction of any transaction expenses. REIT Total Return's advisory fees are simulated and applied retroactively to present the portfolio return “net-of-fees”.

Calculation Methodology. Returns are calculated by 2MC with data from Interactive Brokers LLC using the Modified Dietz method, a time-weighted measure of performance in which cash flows are weighted based on their timing. Dividends in REIT Total Return are reinvested.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.