Are There Still Opportunities Available in a Stock Market at an All-Time High?

Does this mean that the entire stock market is uninvestable at current inflated valuations? Well, much of the market is certainly overvalued (in some cases severely so), but we have identified opportunities that are not only not overvalued, but rather are trading well below fair value.

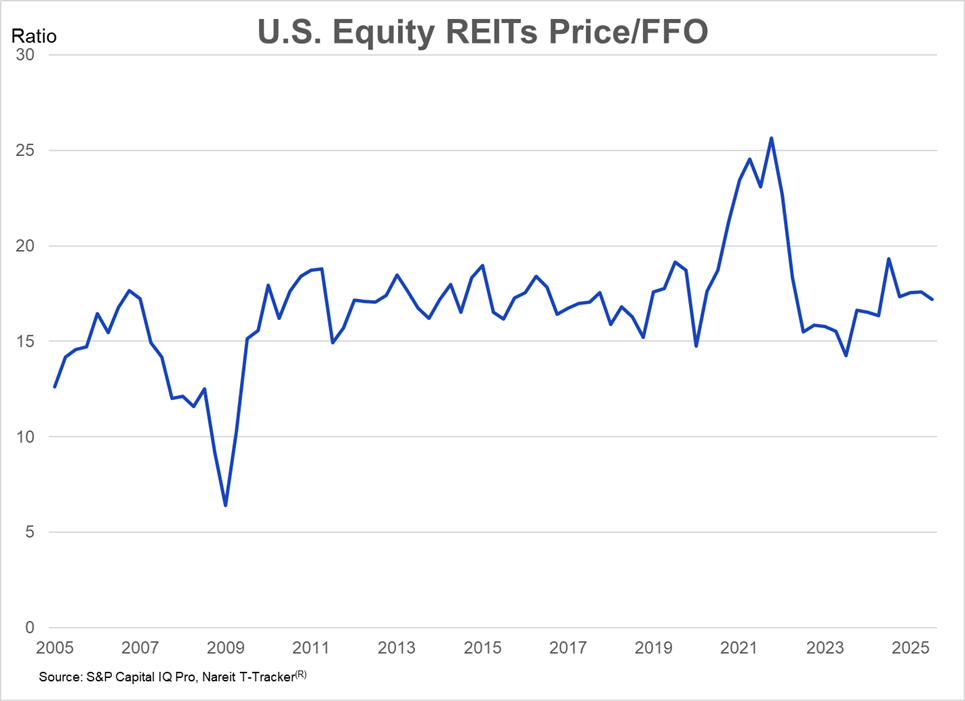

The Real Estate Investment Trust (REIT) sector is currently trading at a multiple largely in line with historical norms, rather than at a near-record high like the broader market. Within the REIT sector, however, there are numerous high-quality REITs whose common and preferred shares are trading at prices well below fair value. At 2nd Market Capital, we see this as highly opportunistic, particularly relative to the wildly inflated valuations in the broader market.

There are two components of total return: capital gains and income. We have developed a strategy to capitalize on both via these discounted securities. Introducing Baseline+:

The Baseline:

Collect strong dividend yields from discounted shares of Real Estate Investment Trusts (REITs) and infrastructure companies.

The Plus (+):

Potential for significant price appreciation as these securities trade up toward fair value. Actively trade these securities to continuously capitalize on opportunities.

2nd Market Capital’s Strategy: Invest in discounted common and preferred securities with strong yields 150+ basis points above the 10-year treasury. As a baseline, the portfolio will receive this high yield cash flow. Plus, over time, the share prices of these discounted preferred securities could appreciate up toward their par value, and common shares up toward their net asset value. Additionally, dividend proceeds plus trading gains can be reinvested into additional discounted securities to create a compounding effect that produces a growing stream of portfolio cash flow over time.

Anticipated Mechanisms to achieve the Plus(+):

- Actively trading between common and preferred securities from different issuers to capitalize on price movements with a focus on maximizing total return.

- Actively trading between multiple preferred securities from the same issuer to arbitrage pricing disparities and capture additional value above and beyond the yield that would be received by merely holding the same security for the entire period.

- As treasury yields fall, high-yielding securities become even more attractive on a relative basis, generating increased investment into these securities and driving up the share price.

- Companies buy back their own discounted common and preferred shares to achieve a high return, which drives up the share price.

- Companies redeem the preferred shares at par, providing a full capture of share price upside in addition to the high yield that was collected while waiting for the redemption.

- Companies trading at sizeable discounts to NAV often present an attractive M&A target and are sometimes acquired at a large premium to current share price, resulting in strong price appreciation.

Compounding is Powerful

Get started on compounding your assets by opening a Baseline + account today. Discounts present in today’s market prices afford getting in at a higher dividend yield which essentially provides a faster rate of compounding. We actively manage stock selection to keep accounts invested in current opportunities with strong fundamentals and favorable valuation.

If you’re interested in learning more about our advisory services, please contact Simon Bowler or Dane Bowler:

Simon Bowler

Chief Communication Officer

Dane Bowler

Chief Investment Officer

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.