Americold Gets Cheap Enough to be Interesting

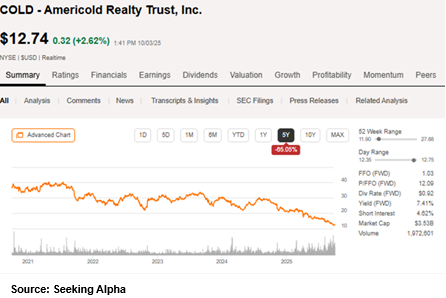

Americold’s (COLD) stock price is down 65% in the last 5 years. This sort of move is unusual for a business that is so necessary and stable in the long-term sense of the word. In any short window of time, cold storage volumes have vicissitudes, but over any long stretch of time, the trend is consistently up. The world has used significantly more cold storage each decade than the previous decade, and there is a strong consensus that we will use it even more going forward.

This leads us to a juxtaposition of information that seems incompatible:

- COLD is a global market share leader in cold storage (along with Lineage).

- Long-term business trends are positive, including analyst estimates of earnings (AFFO/share)

- COLD stock is down 65%.

How can these coexist?

Why COLD dropped so much

Our analysis attributes the enormous price drop to 3 factors:

- COLD was significantly overvalued 5 years ago

- Oversupply as supply chains adjusted for a high inventory environment that proved not to be permanent

- COLD market price overshot on the selloff as major institutions dumped shares into too few buyers

The market tends to extrapolate current trends when the economic reality leans much more toward a return to mean.

The longstanding tradition of companies that sell physical goods is to run as lean on inventory as possible, which is, of course, the most financially efficient way to operate. A business can only run lean, however, when supply chains are smooth and reliable.

Well, during the pandemic shutdown, everything became an unknown, and supply chains were no longer smooth or reliable. Businesses were faced with a choice to either risk frequently running out of products to sell or run at substantially higher inventory levels.

Running out of products to sell means no revenue so businesses overwhelmingly chose to beef up their inventory.

Larger inventory is unequivocally good for cold storage. COLD is paid per pallet stored, as well as getting service revenues for throughput.

While the inventory glut brought about by the pandemic was a positive for COLD’s business, the market traded it wrong.

When a cyclical business is at the peak of its cycle, it should trade at low multiples because the cycle will inevitably return to mean.

The market likes to extrapolate rather than read cycles for what they are. So it traded COLD at multiples over 30X at a time when its earnings were abnormally high due to the inventory glut.

This led to a double whammy for COLD’s stock price. Earnings would eventually have to weaken as inventories returned to more normal levels, and the multiple would eventually have to come down from the 30X level, which implied rapid growth.

So down it went.

Just as the market made the mistake of extrapolating peak inventory as a permanent uptrend, it is now making the mistake of reading low inventory/throughput as a permanent downtrend.

So COLD is trading at very low multiples at the same time as earnings are in a trough.

That just is not a mathematically correct way to trade cyclical companies.

Analysts understand the business cycle. They see that earnings are dropping in 2025 and 2026, but are positioned to rebound in 2027 and reach new highs in 2028.

So unless the consortium of analysts that follow COLD are extremely wrong in their forecasts, the market is putting a trough multiple on a company at trough earnings.

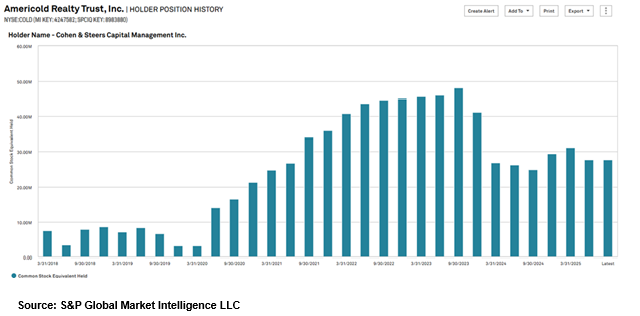

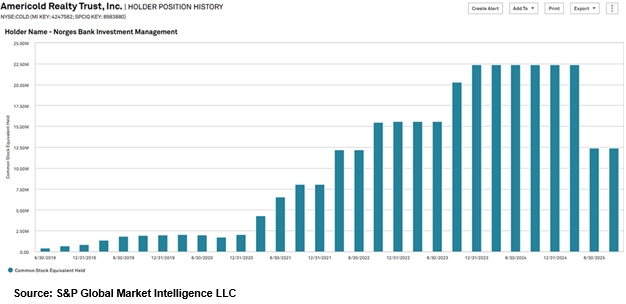

Perhaps part of the overshoot in COLD’s selloff is related to large institutions dumping shares into a market that was already bearish on the stock.

Cohen and Steers dumped about 20 million shares.

Norges Bank sold about 10 million shares.

I posit that these large volume sales accelerated the downtrend in COLD’s stock price and caused it to drop further than it should have.

So that is how COLD got here. Let us now look at COLD’s fundamentals and its valuation.

Fundamental troubles appear to be at industry level rather than company level

In my opinion, there is a big difference between a company struggling versus an industry downturn.

An industry downturn will be subject to a cyclical rebound, whereas an individual company struggling may permanently lose market share.

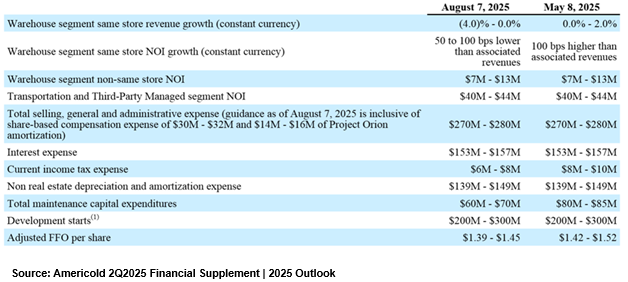

COLD cut its earnings guidance on August 7th, 2025, reducing the low end of its revenue forecast to -4%.

Notably, Lineage Logistics (LINE) also cut its earnings around the same time with a full 20 cent cut to AFFO.

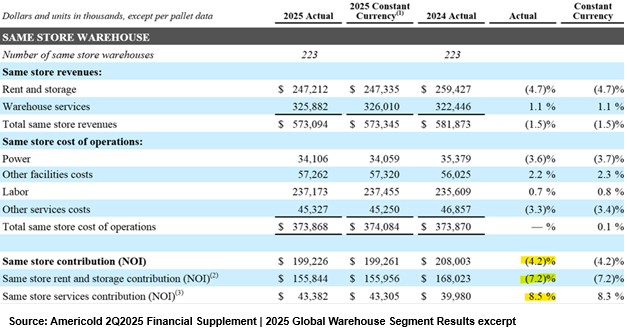

LINE and COLD are the top 2 players in the industry by a significant margin so if they are both struggling it is very likely to be an industry level problem. Also worth noting is the nature of lost revenues is in pallet volume rather than services as highlighted below.

Service revenue being up indicates that customer end usage of frozen items is still strong. The negative adjustment to storage revenue just indicates that tenants are sitting on lighter inventory volumes.

This matters because there is a finite minimum level of inventory at which tenants can run. If they are already running lean, they cannot drop inventory much further.

I see this as additional evidence that the bottom is nearly in. I think somewhere between now and the first half of 2026 will be the trough, followed by a rebound.

Storage margins dropped 180 basis points in 2Q25, but remain healthy at 63%. Service margins are lower at 13.3%, but that segment grew margin by 90 basis points.

Americold’s future will hinge on 3 factors:

- Stabilized inventory

- Stabilized throughput level

- Stabilized margins

Inventory levels are hard to predict because it mostly depends on how secure tenants feel about the smoothness of their supply chains. There is, however, a range in which inventory levels will likely stay. The 2021 era represents the top of that range while we believe the present environment is quite close to the low end of that range.

So while we cannot predict where inventory levels will be at any given time in the future, we think they are firmly below the mean.

Throughput volume will scale with overall consumption. Historically it has consistently increased. We believe this will continue, albeit at a slower pace as population growth is slower than historical averages.

Margins are a bit of an unknown. Higher electricity costs have hurt a bit, but COLD has managed to do some cost cutting and efficiency initiatives that have been fairly effective at keeping margins up even in the challenging environment. I suspect current margins are approximately at stabilized levels and will flex up and down with cyclicality.

Overall, I think long term fundamentals are reasonably good. The cold storage industry has secular growth, and COLD has a large market share within it.

Valuation

After the massive drop in share price, COLD looks extremely cheap at 55% of net asset value.

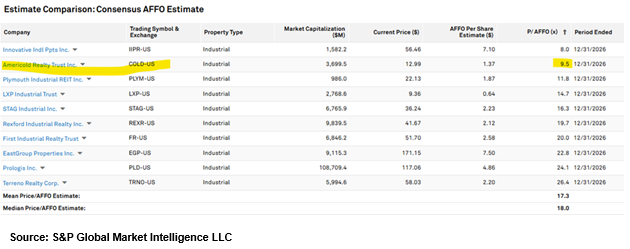

It is also trading at 9.5X forward consensus AFFO.

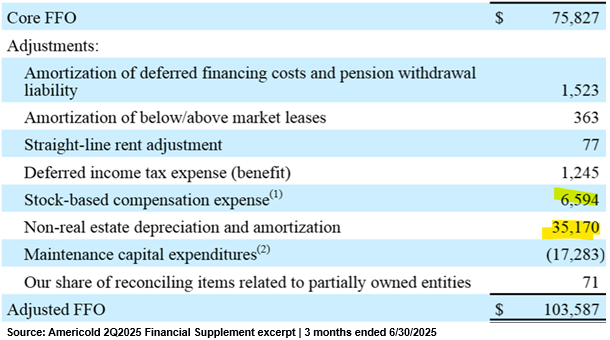

AFFO can be a wonky metric, however, as each company defines it differently. In the case of COLD we think they have a couple of addbacks that don’t really reflect what we would consider true earnings.

Specifically, the 2Q25 supplemental shows addbacks for non-real estate depreciation and stock-based compensation.

The non-real estate equipment does break down over time so I would consider amortization of replacement costs to be a real expense, even if it not a cash expense in this particular quarter.

Stock comp is the same where it is non-cash, but the dilutive cost is real.

After adjusting for these line items, we see true AFFO of $61.823 million or about 60% of stated AFFO. This annualizes to $247 million or about $0.87 per share.

At today’s price that is a 14.6X multiple on true AFFO.

Compared to the industrial REIT sector, COLD is not as cheap as the 9.5X AFFO at which it screens.

But 14.5X AFFO is still substantially cheaper than most of its peers.

Getting back to the concept of cyclicality as it impacts multiples, a company should trade at a slightly above average multiple when at its earnings trough. 2026 is likely COLD’s earning trough based on my analysis and the consensus of analysts that follow COLD.

Thus, I think COLD is a good value at 14.5X trough AFFO.

How we are playing it

It is not as outrageously cheap as it screens, but a good value. REITs have a tendency to trade based on recent growth rates, so I would not be surprised if COLD’s stock continues to fall a bit more through the end of the year. As such, we are limping in slowly. COLD is already a solid value on its long-term growth rate and could become an excellent stock as fundamentals turn positive, which, in my opinion, will pull its AFFO multiple up toward 18X.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.