REIT Total Return: Full Portfolio Review Heading into 2026

Scarcity is a key economic concept that drives so many aspects of the free market. Perhaps the most obvious application is scarcity of resources, and there are countless examples of how that impacts prices.

- Scarcity of electricity ⇒ higher electricity prices

- Scarcity of labor ⇒ wage inflation

- Scarcity of commodities ⇒ higher commodity prices

It gets a bit trickier when the source of scarcity is not a good or a service, but rather a concept. The scarce concept I want to talk about today is scarcity of value.

In the last couple of years, growth has become abundant while value has shrunk to small, overlooked niches within a broadly frothy market. Let us begin with a demonstration of how extreme valuation has gotten, and then follow with our approach to finding quality within the small pockets of value, such that we have been able to maintain a low P/AFFO multiple in the REIT Total Return (RTR) portfolio.

The expensive market

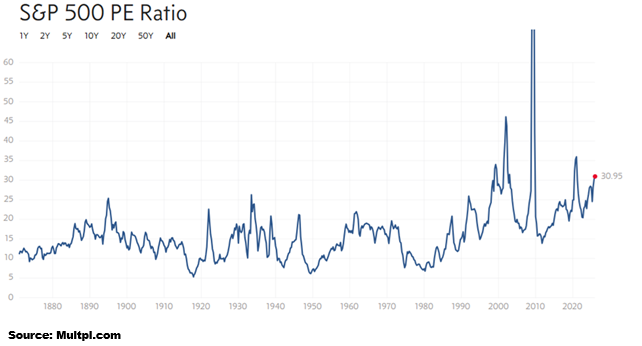

On trailing earnings, the S&P 500 is trading at 30.95X, making it the most expensive outside of a few extreme periods like the dot-com bubble or when earnings dipped to basically zero during the Financial Crisis.

It is even more expensive using normalized earnings figures such as the Shiller PE.

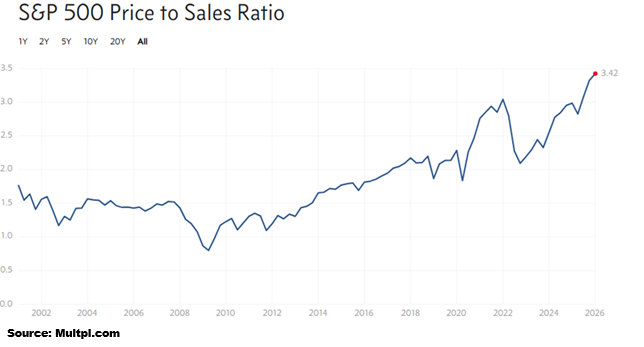

Price to sales data is a bit hard to track before the turn of the century, but it appears to be quite high relative to history.

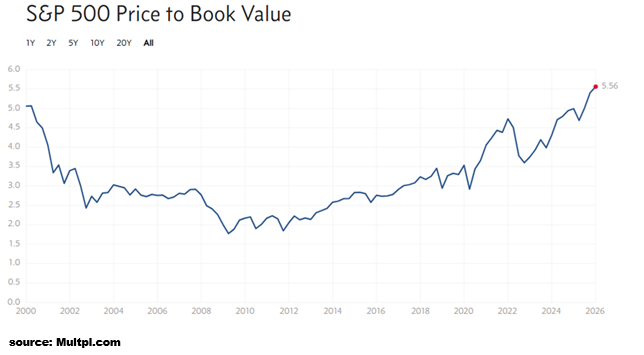

Finally, the price-to-book ratio has even exceeded the heights of the dot-com bubble.

Given the variety of metrics reading at or close to all-time highs, the stock market is clearly at a high valuation.

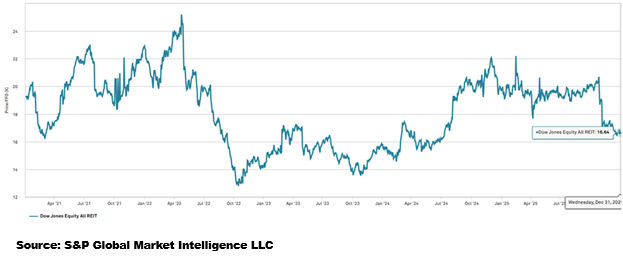

Within it, there are pockets of relative value. Utilities and REITs are quite cheap relative to the S&P 500, but only normal relative to themselves. Both utilities and REITs are trading roughly in line with their historical norms. REITs are more relevant to this portfolio, so let us dig into the data a bit.

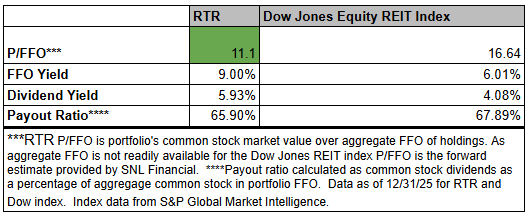

At the close of 2025, the Dow Jones Equity REIT index was trading at 16.64X FFO.

This is well within the normal valuation of REITs, which has often been between 14X and 18X.

Thus, I would posit that REITs are cheap relative to the S&P, but at normal valuation relative to themselves.

Finding value

The REIT index multiple suggests the sector is at about fair value, but note that the index is market cap weighted, and it so happens to be the large cap and mega cap REITs that are trading at high valuations.

The average REIT, by median, trades at just 12.9X FFO. That would imply that out of the 180 equity REITs, there are 90 at 12.9X or below.

That is a healthy pool of value in a market where value is otherwise scarce.

A fair number of the REITs trade at low valuations due to one or more of the following problems:

- Challenged property sector (office, hotel, certain types of healthcare)

- Bad balance sheet (very high leverage causing strains on cashflow)

- Bad management (companies with a history of shareholder-unfriendly actions)

- Current oversupply or low growth

Our job as REIT specialists in this market environment is to find REITs among those trading at attractive valuations that do not belong there.

We don’t want to own value stocks that fundamentally should be trading at a discount.

We want to own high quality, growing REITs that have slipped into a low valuation. In our search, we have discovered a variety of factors that seem to lead to the market undervaluing an otherwise strong company:

- Prevalent misconception about some aspect of a company’s business

- Extrapolation of previous trajectory overlooking an inflection point

- Timing of leases hitting earnings statements

- Critical occupancy thresholds

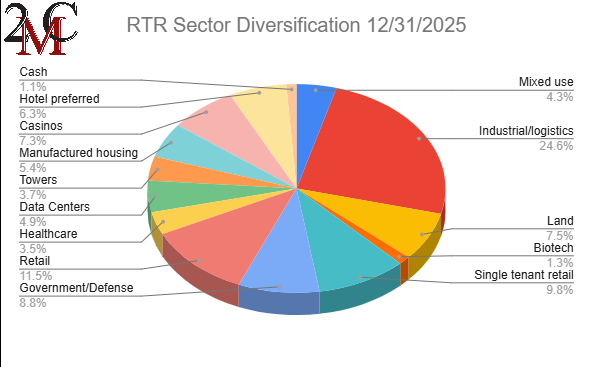

A large portion of the holdings in RTR fit one or more of these descriptions. We shall take a look at the portfolio as a whole and then dig into the individual stocks.

Quarterly performance review

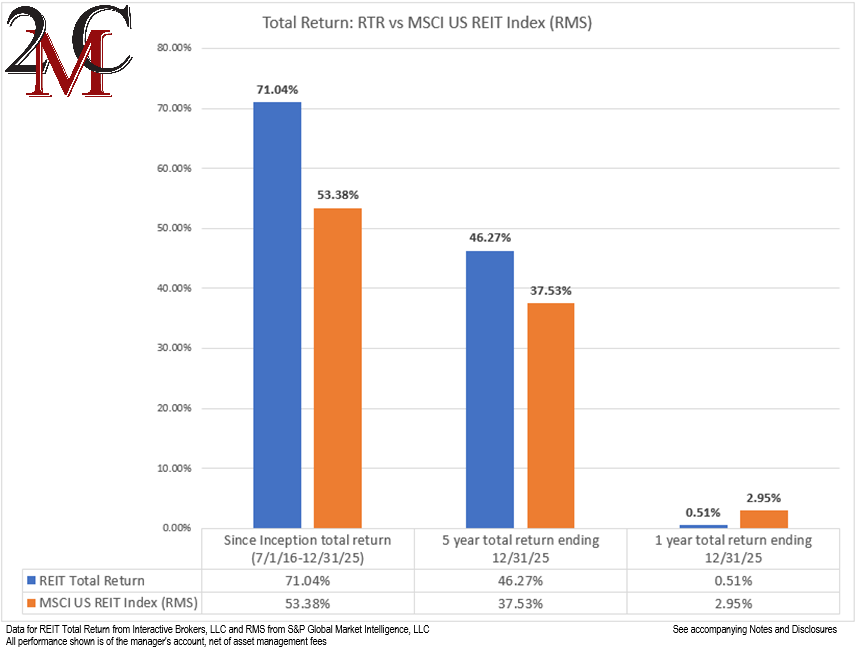

Each quarter, we post the total return of RTR over the 1 year, 5 year and since inception periods.

2025 was a tough year for both the REIT index and RTR, but over long periods of time, we have substantially outperformed our benchmark, the MSCI US REIT Total Return Index (RMS). Specifically, RTR returned 71.04% since it began trading on 7/1/16, while the RMS returned 53.38%.

Portfolio heading into 2026

RTR has an 11.1X FFO multiple, making it a substantially deeper value than the REIT index at 16.64X and vastly cheaper than the S&P 500.

FFO multiples are, of course, different than EPS multiples, but through much of the last 50 years, REIT FFO multiples have tracked within a similar range to S&P EPS multiples.

It is a recent phenomenon that REITs have stayed at fairly cheap valuations while the S&P has approached historic highs across a variety of metrics.

We did not achieve the low multiple of RTR by buying discounted sectors. In fact, we are concentrated in the premium sectors like industrial, manufactured housing, shopping centers, and data centers.

Going forward

We think REITs broadly are better positioned going into 2026. Construction boomed in 2022 and 2023, which caused high deliveries of competing supply in 2024 and 2025. After interest rates rose, that construction activity died down substantially, and the remaining pipeline of delivered square feet is far more subdued. With lower supply on the horizon, organic growth rates across many property sectors are likely to improve.

We see this strong fundamental outlook, combined with the relative value of REITs, to be a boon for the sector. As always, we will try our best to outperform the REIT sector by selecting REITs that our analysis suggests offer a better mix of quality and value.

Evolving economies create opportunity

Our REIT Total Return Portfolio is actively managed to pivot into wherever the opportunity is greatest. We are now offering portfolio mirroring in which the trades in our REIT Total Return Portfolio are automatically executed in client portfolios simultaneously and at the same price.

Important Notes and Disclosure

Material Market and Economic Conditions. March 2022-2023: Significant increases in the Federal Funds Rate by the Federal Reserve have caused REIT market prices to decline more than the broader markets. REITs rely on debt financing to acquire properties and fund their operations; expiring lower-cost debt is being refinanced at higher interest rates due to prevailing market conditions. March 2020: REIT Total Return’s value declined substantially as COVID shut down the economy. It recovered in 2021 as the economy reopened. January 2019: Tax-loss selling’s calendar expired and the government reopened on January 25, 2019. The combined effect caused our shares to rise more than the broader markets. December 2018: Another Fed-Funds rate hike, unresolved US-Chinese trade, a partial government shutdown, and an exaggerated tax-loss selling season put extreme downward pressure on equity prices. All of these factors contributed to diminished liquidity and more significant share price declines in small-cap/value issues; REIT Total Return is focused on small-cap/value issues, so our decline was significantly more precipitous.

Material Conditions, Objectives, and Investment Strategies. REIT Total Return is an actively managed investment portfolio of real estate equities, primarily common and preferred shares of REITs, with an aim to generate high total returns from a mix of dividends and capital appreciation.

All REIT Total Return Portfolio performance information on this page is based on the performance of the Portfolio Manager’s account, using the manager’s own funds. Performance of the Portfolio Manager's account is calculated by Interactive Broker on a daily time-weighted basis, including cash, dividends and earnings distributions, and reflects the deduction of broker commissions (when commissions were charged). Actual client returns will differ. **2nd Market Capital’s advisory fees are simulated and applied retroactively to present the portfolio return “net-of-fees”.

None of the performance information displayed on this page is based on the actual performance of any 2MCAC client account investing in this portfolio. The performance in a 2MCAC client account investing in this portfolio may differ (i.e., be lower or higher) from the performance of the account managing this portfolio and portrayed on this page based on a variety of factors, such as trading restrictions imposed by the client (resulting in different account holdings), time of initial investment, amount of investment, frequency and size of cash flows in and out of the client account, applicable brokerage commissions (when commissions were charged), and different corporate actions. Clients investing in this portfolio may view the actual performance of their investment in this portfolio by logging into their Interactive Brokers account and reviewing their customized dashboard.

Clients may restrict any of the securities traded in their account but should note that any restrictions they place on their investments could affect the performance of their account leading it to perform differently, worse or better, than (a) the above-portrayed account or (b) other client accounts invested in the same portfolio.

Forward-looking statements. Commentary may contain forward-looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in these documents.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this commentary have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

Use of Leverage or Margin. REIT Total Return Portfolio will utilize margin only for trading purposes (the ability to use the proceeds from stock sales immediately for new purchases instead of waiting for settlement), but not for borrowing purposes.

Benchmark Comparison. Our REIT Total Return Portfolio is compared to the Dow Jones Equity REIT Index and the MSCI U.S. REIT index because they are common REIT Indices. The Dow Jones Equity All REIT Index is designed to measure all publicly traded equity real estate investment trusts (REITs) in the Dow Jones U.S. stock universe. The MSCI US REIT Index is comprised of equity real estate investment trusts (REITs) eligible included within the eight Equity REIT Sub-Industries of the Equity Real Estate Investment Trust (REITs) Industry. It is not possible to invest directly in the Dow Jones Equity All REIT Index or MSCI US REIT index. Index returns do not represent the results of actual trading of investible assets/securities. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the index. The imposition of these fees and charges would cause the actual performance of the securities to be lower than the Index performance shown. The results portrayed include dividend income. Our REIT Total Return Portfolio may include REITs that are not eligible for inclusion in the Dow Jones Equity All REIT Index or MSCI US REIT Index.

There can be no assurance that a benchmark will remain appropriate over time and 2MCAC will periodically review the benchmark’s appropriateness and decide to use other benchmarks if appropriate.

Expenses. Returns reflect the deduction of any transaction expenses. REIT Total Return's advisory fees are simulated and applied retroactively to present the portfolio return “net-of-fees”.

Calculation Methodology. Returns are calculated by 2MC with data from Interactive Brokers LLC using the Modified Dietz method, a time-weighted measure of performance in which cash flows are weighted based on their timing. Dividends in REIT Total Return are reinvested.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.