The State of REITs: August 2025 Edition

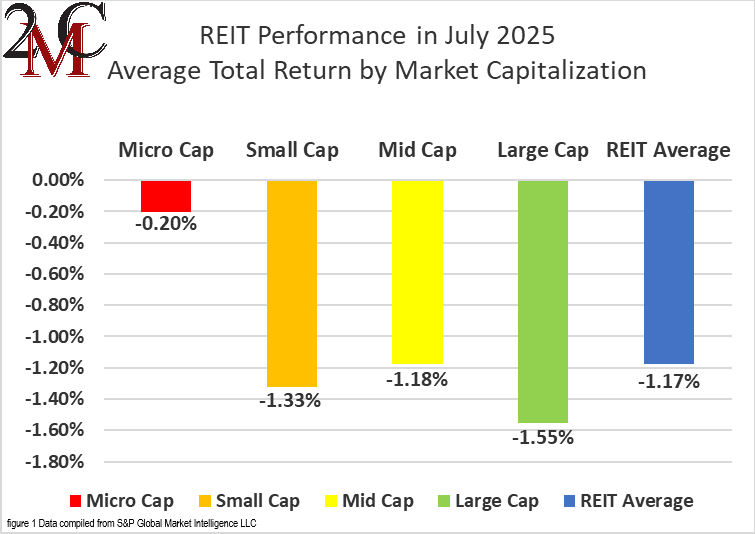

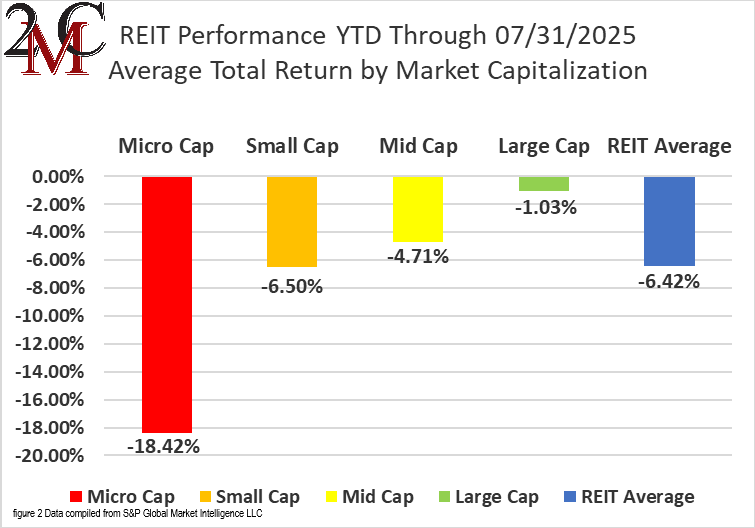

- After a strong June (+2.56%), the REIT sector recovery stalled in July (-1.17%) as REITs fell to a -6.42% year-to-date return.

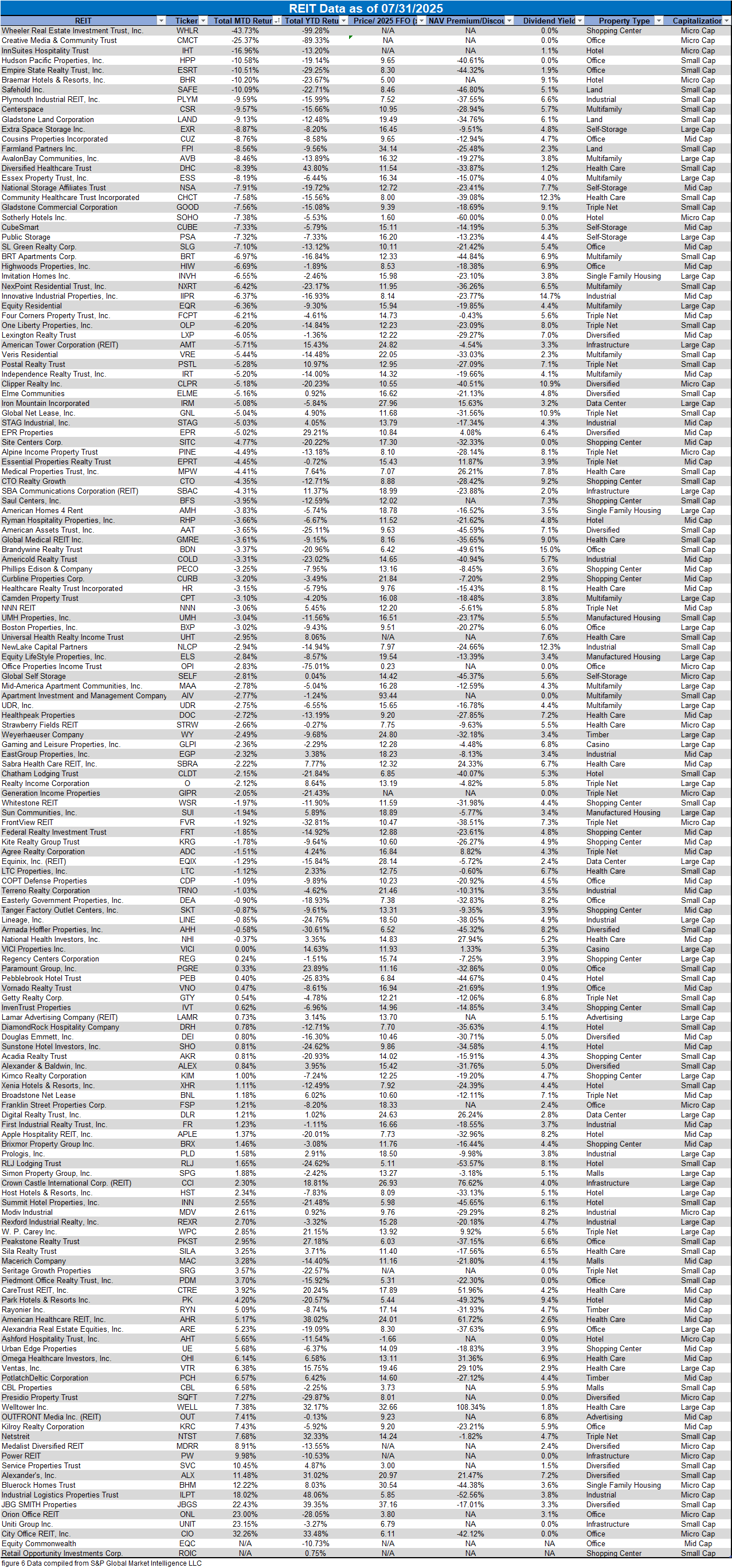

- Micro cap REITs (-0.20%) outperformed in July while mid caps (-1.18%), small caps (-1.33%) and large caps (-1.55%) averaged slightly deeper negative returns.

- 65% of REIT securities had a negative total return in July.

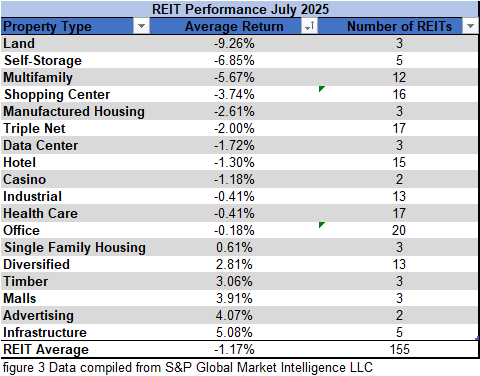

- Only 33% of REIT property types averaged a positive total return in July. Land (-9.26%) and Self Storage REITs (-6.85%) saw the deepest declines, while Infrastructure (+5.08%) and Advertising REITs (+4.07%) solidly outperformed.

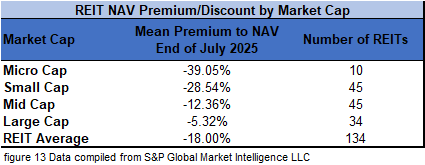

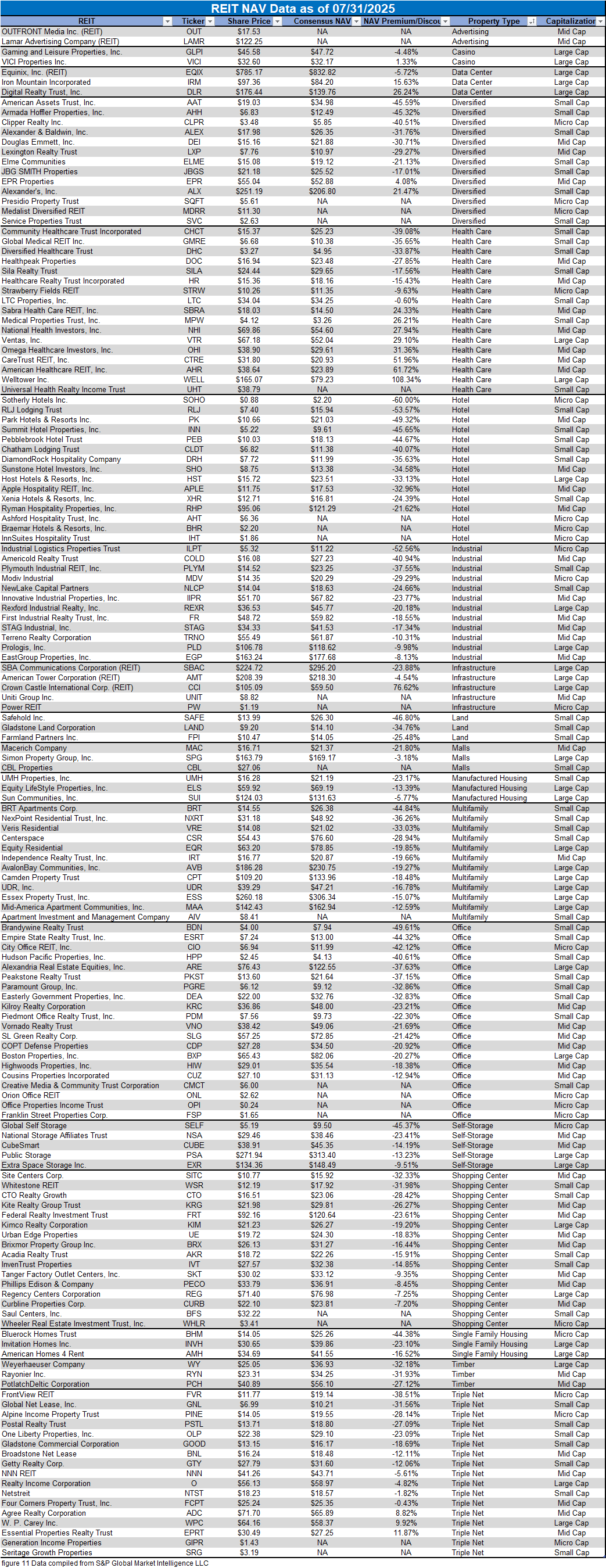

- The average REIT NAV discount widened from -16.36% to -17.85% during July. The median NAV discount also widened from -19.68% to -21.42%.

REIT Performance

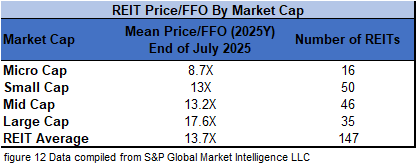

REITs averaged a modest decline in July (-1.17%), again falling short of the broader market which saw positive returns from the NASDAQ (+3.7%), S&P 500 (+2.2%) and Dow Jones Industrial Average (+0.2%). The market cap weighted Vanguard Real Estate ETF (VNQ) slightly outperformed the average REIT in July (+0.09% vs. -1.17%) and has dramatically outperformed year-to-date (+2.10% vs. -6.42%). The spread between the 2025 FFO multiples of large cap REITs (17.6x) and small cap REITs (13.0x) widened in July as multiples held steady for large caps but contracted 0.3 turns for small caps. Investors currently need to pay an average of 35.4% more for each dollar of FFO from large cap REITs relative to small cap REITs. In this monthly publication, I will provide REIT data on numerous metrics to help readers identify which property types and individual securities currently offer the best opportunities to achieve their investment goals.

After badly underperforming in each of the first 5 months of 2025, micro cap REITs (-0.20%) have now outpaced their larger peers in back-to-back months as mid caps (-1.18%), small caps (-1.33%) and large caps (-1.55%) averaged deeper negative returns in July. During the first seven months of 2025, large cap REITs have outperformed small caps by 547 basis points.

Only 6 out of 18 Property Types Averaged Positive Returns in July

66.67% of REIT property types averaged a negative total return in July. There was a 14.34% total return spread between the best and worst performing property types. Infrastructure (+5.08%) and Advertising (+4.07%) saw the strongest returns in July. Land (-9.28%) and Self Storage REITs (-6.85%) underperformed all other REIT property types.

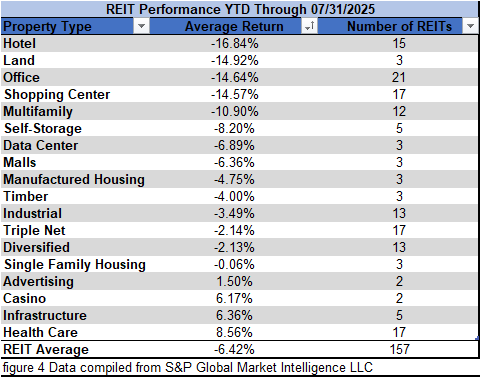

Hotel (-16.84%), Land (-14.92%), Office (-14.64%), Shopping Center (-14.57%) and Multifamily REITs (-10.90%) struggled over the first seven months of 2025 with double-digit average declines. Health Care (+8.56%), Infrastructure (+6.36%), Casino (+6.17%) and Advertising (+1.50%) were the only property types to average positive returns over the first seven months of the year.

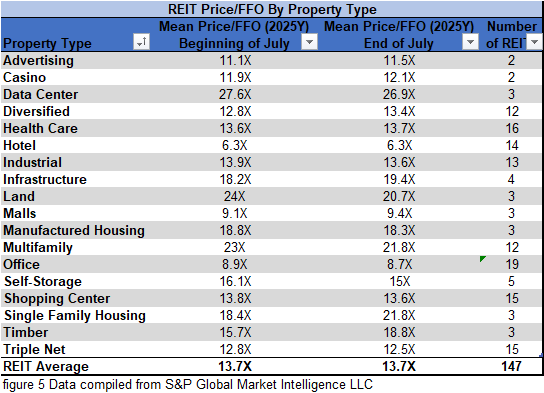

The REIT sector as a whole saw the average P/FFO (2025Y) remain unchanged at 13.7x in July. 44.4% of property types averaged multiple expansion, 50% averaged multiple contraction and 5.6% saw multiples hold steady in July. Data Centers (26.9x), Single Family Housing (21.8x), Multifamily (21.8x), Land (20.7x) and Infrastructure (19.4x) currently trade at the highest average multiples among REIT property types. Hotels (6.3x), Office (8.7x) and Malls (9.4x) are the only property types that average single digit FFO multiples.

Performance of Individual Securities

City Office REIT (CIO) (+32.26%) surged in July after announcing on July 24th that they will be acquired by MCME Carell at a price of $7.00/share. The transaction is expected to close during the 4th quarter of 2025. CIO also announced that the July 24th dividend was the final common dividend distribution and that the common dividend will be suspended through the close of the acquisition.

After a rare month in the black in June (+52.26%), Wheeler REIT (WHLR) returned to freefalling in July (-43.73%) as it underperformed all other REITs. Over the first 7 months of 2025, WHLR has amassed a sector-worst -99.28% total return.

39.35% of REITs had a positive total return in July. REITs have averaged a -6.42% year-to-date total return in 2025, which falls far short of the +3.83% return for the REIT sector over the first seven months of 2024.

Dividend Yield

Dividend yield is an important component of a REIT’s total return. The particularly high dividend yields of the REIT sector are, for many investors, the primary reason for investment in this sector. As many REITs are currently trading at share prices well below their NAV, yields are currently quite high for many REITs within the sector. Although a particularly high yield for a REIT may sometimes reflect a disproportionately high risk, there exist opportunities in some cases to capitalize on dividend yields that are sufficiently attractive to justify the underlying risks of the investment. I have included below a table ranking equity REITs from highest dividend yield (as of 7/31/2025) to lowest dividend yield.

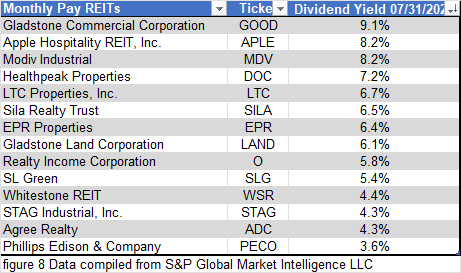

Although a REIT’s decision regarding whether to pay a quarterly dividend or a monthly dividend does not reflect on the quality of the company’s fundamentals or operations, a monthly dividend allows for smoother cash flow to the investor. Below is a list of equity REITs that pay monthly dividends, ranked from highest yield to lowest yield.

Dividend News

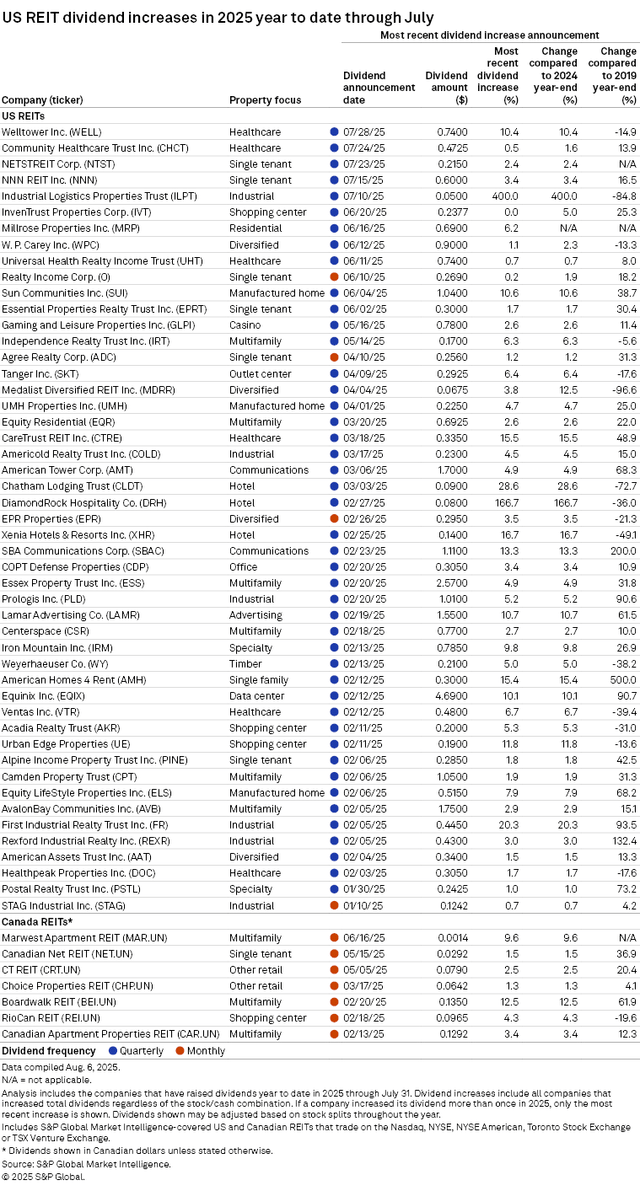

5 REITs announced quarterly dividend increases in July. The largest dividend increase came from Industrial Logistics Properties Trust (ILPT) (+400.00%), which quintupled their dividend. However, even after this hike ILPT’s dividend is still 84.8% lower than it was at the end of 2019. In total, 49 REITs have raised their dividend during the first seven months of 2025.

Economic Health

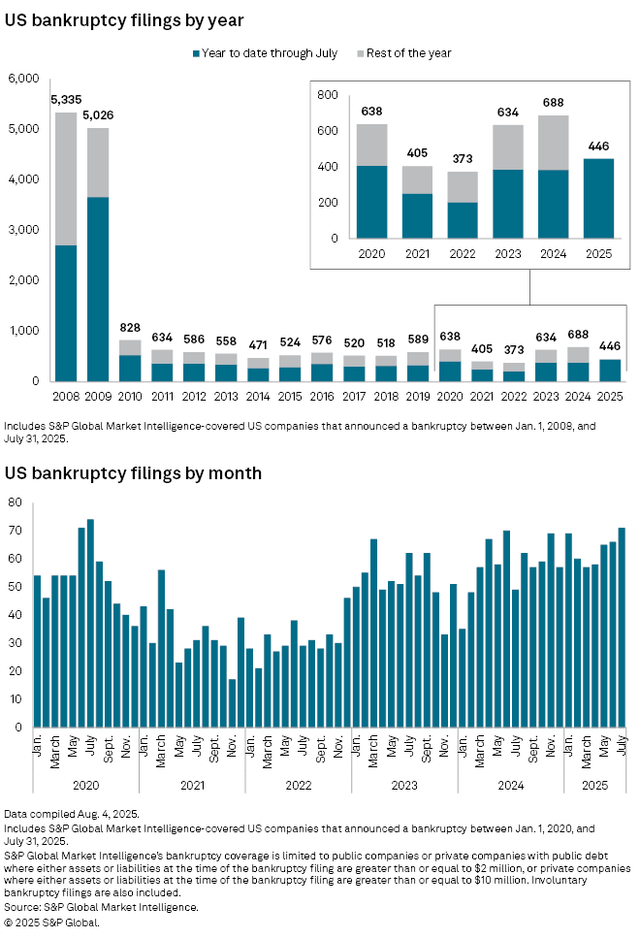

The number of corporate bankruptcies rose month-over-month for the 4th straight month in July (after an upward revision to June’s figure) and reached the highest monthly total since July 2020 as elevated interest rates continue to strain heavily indebted companies. There were more filings year-to-date in 2025 than in the first 7 months of any other year since 2010.

Valuation

REIT Premium/Discount to NAV by Property Type

Below is a downloadable data table, which ranks REITs within each property type from the largest discount to the largest premium to NAV. The consensus NAV used for this table is the average of analyst NAV estimates for each REIT. Both the NAV and the share price will change over time, so I will continue to include this table in upcoming issues of The State of REITs with updated consensus NAV estimates for each REIT for which such an estimate is available.

Takeaway

The large cap REIT premium (relative to small cap REITs) widened in July and investors are now paying on average about 35% more for each dollar of 2025 FFO/share to buy large cap REITs than small cap REITs (17.6x/13.0x – 1 = 35.4%). As can be seen in the table below, there is presently a strong positive correlation between market cap and FFO multiple.

The table below shows the average NAV premium/discount of REITs of each market cap bucket. This data, much like the data for price/FFO, shows a strong, positive correlation between market cap and Price/NAV. The average large cap REIT (-5.32%) trades at a single-digit discount to consensus NAV and mid cap REITs (-12.36%) trade at a low double-digit discount. Small cap REITs (-28.54%) trade a little below 3/4 of NAV while micro caps (-39.05%) trade at only about 3/5 of their respective NAVs.

Mixed July Inflation Data Leaves Potential Rate Cut Path Unclear

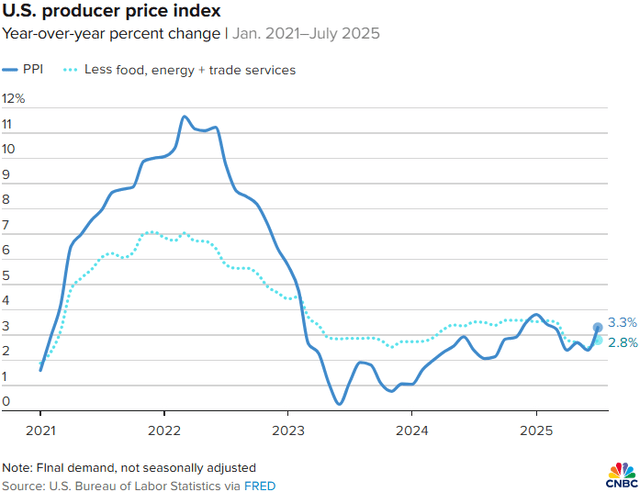

After declining nicely through the first half of 2025, the producer price index (PPI) spiked up sharply (+0.9% month-over-month) in July. It is not yet clear whether this sharp single month increase in PPI reflects a full or partial tariff impact, so it will make the next few months of data all the more important to monitor.

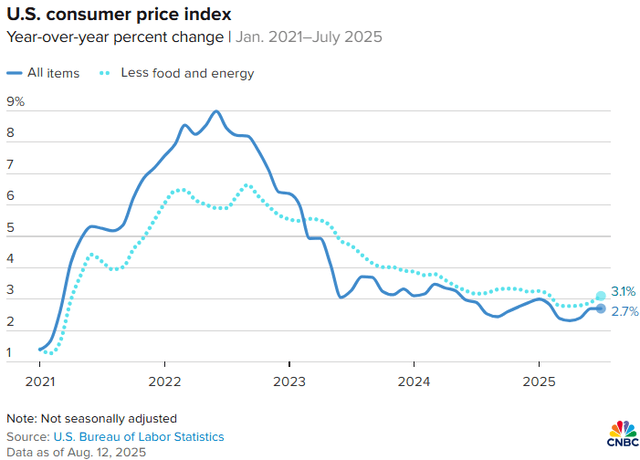

Consumers, however, are still not yet seeing any material tariff impact as the consumer price index (CPI) held steady at 2.7% in July and remains lower than the 3% inflation at the start of the year. The PPI is traditionally a leading indicator, so we have yet to see whether or to what extent the July PPI spike could pass through to consumers over upcoming months.

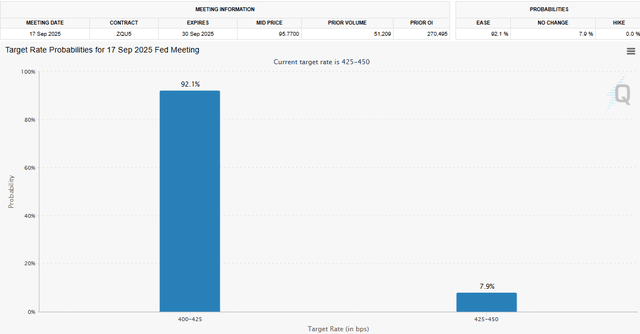

July 30th marked the 5th straight meeting at which the Fed Funds rate was left at 4.25% – 4.50%. However, it also marked the first meeting since 1993 in which two Fed governors dissented from a Fed decision. This dissent came from a preference from both dissenting governors for a rate cut. After seeing both the PPI and CPI data (as well as many other data points), FedWatch odds of a September rate cut have risen to over 90% (as of 08/16).

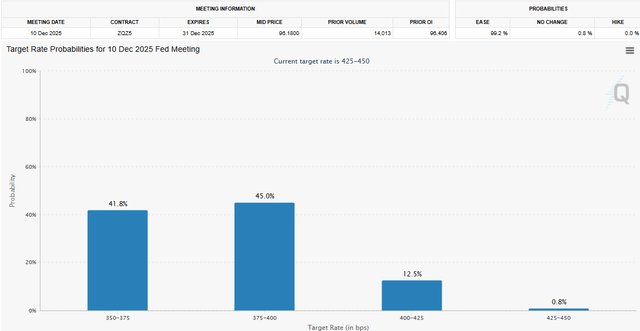

FedWatch odds of at least one rate cut by year end are now over 99% (as of 08/16) with odds of a total of 75 basis points of cuts now at 41.8%. These odds will change with each new economic data point released, but currently suggest market expectations of multiple cuts beginning in September.

The REIT sector got pummeled as the Fed rapidly raised rates in a sharp course correction after their “transitory” inflation theory proved inaccurate. If the Fed initiates a new rate cutting cycle, however, it could have the opposite effect for REITs as it could fuel cap rate compression and a lower cost of debt. Cap rate compression would raise the value of REIT assets while a declining cost of debt would facilitate accretive refinancings and improve cash flow. Due to the greater impact that changes in interest rates have on the REIT sector relative to most other sectors of the markets, a robust rate cutting cycle could drive REIT outperformance over upcoming quarters. However, the timing and magnitude of cuts will be heavily impacted by a litany of economic data points over upcoming months, so active investors would be wise to closely follow both individual company level reporting as well as economic data trends to identify opportunities to attain alpha.

Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

We cannot determine whether the content of any article or recommendation is appropriate for any specific person. Readers should contact their financial professional to discuss the suitability of any of the strategies or holdings before implementation in their portfolio. Research and information are provided for informational purposes only and are not intended for trading purposes. NEVER make an investment decision based solely on the information provided in our articles.

We may hold, purchase, or sell positions in securities mentioned in our articles and will not disclose this information to subscribers, nor the time the positions in the securities were acquired. We may liquidate shares in profiled companies at any time without notice. We may also take positions inconsistent with the information and views expressed on our website.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to our clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Through October 2021, The State of REITs was published exclusively on Seeking Alpha by Simon Bowler, Sector Analyst at 2nd Market Capital Services Corporation (2MCSC). Editions subsequent to October 2021 will be published on this website in addition to other platforms that may include Seeking Alpha. 2MCSC was formed in 1989 and provides investment research and consulting services to 2nd Market Capital Advisory Corporation. 2MCSC does not provide investment advice. 2MCSC is a separate entity but related under common ownership to 2nd Market Capital Advisory (2MCAC), a Wisconsin registered investment advisor. Simon Bowler is an investment advisor representative of 2MCAC. Any positive comments made by others should not be construed as an endorsement of the author's abilities to act as an investment advisor.

S&P disclosure: S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.